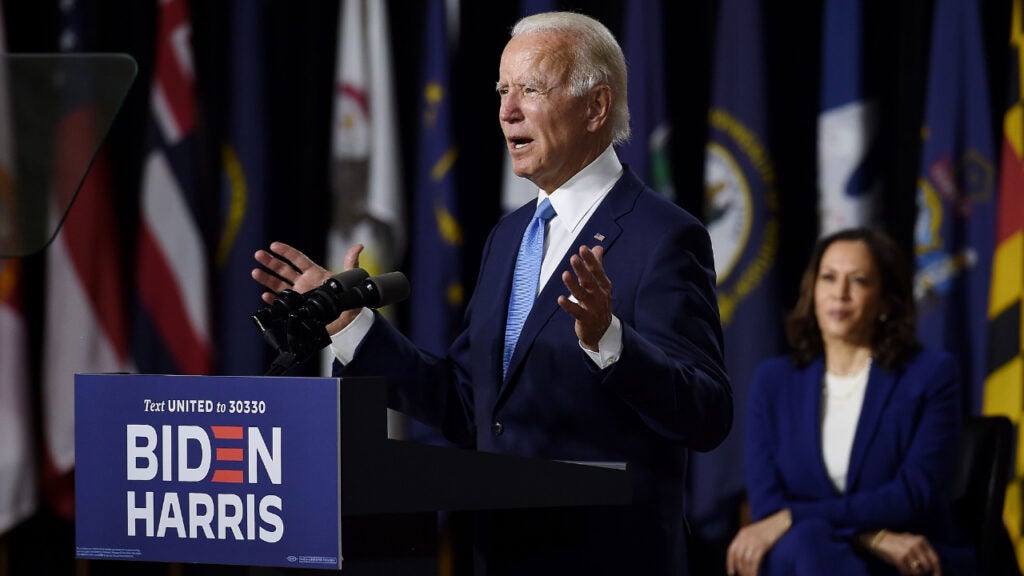

Sometime before President Joe Biden’s speech to Congress on Wednesday, the president will lay out the details of a tax plan to help pay for his infrastructure proposal and other domestic proposals.

Tucked within those plans are proposals to nearly double the tax rate for capital gains and eliminate stepped-up basis beyond a $1 million exemption as well.

The plan would raise the capital gains rate from 20% to 39.6% for people who earn more than $1 million. When tacking on the Medicare surtax, the highest rate would to 43.4% on capital gains. IRS data from 2018 returns shows this would only affect about one-third of 1% of American taxpayers — .32% — who have adjusted gross income of more than $1 million, as well as having capital gains or losses on their tax returns, Bloomberg reports.

Biden also had campaigned on increasing the capital-gains rate for wealthier Americans. Biden and most congressional Democrats argue capital-gains rates should be on par with taxes on regular income.

The plan also calls for raising the corporate tax rate from 21% to 28% as well.

And in another proposal expected to come from the president, he will pitch a plan to eliminate stepped-up basis when passing on property to heirs.

The effect of the plan – if it were to become law – would be to drive wealthier people to sell off assets before they die for better tax treatment than handing down the assets to their heirs who were intent on selling them anyway.

While few people in agriculture earn $1 million or more a year, farmers and livestock producers could find themselves caught the capital-gains situation when they go to sell large equipment, but the higher capital-gains rate will hit farmers and ranchers more when they go to sell land, or pass it down to their heirs.

When it comes to land values today, it takes less than 135 acres in Iowa to hit $1 million in value. With the average size of a farm in the state at 359 acres, that’s topping $2.7 million in value.

In an analysis earlier this month by the American Farm Bureau Federation and American Soybean Association, they highlighted that the average value of farm ground has increased 223% since 1997. In some northern Midwest states, the value increases average more than 300%.

AFBF and ASA economists noted stepped-up basis “provides a reset for the asset value basis during intergenerational transfers.” Heirs would be hit with higher taxes when they sold the land.

“Eliminating stepped-up basis to generate more federal income risks the livelihood of America’s family farms and economic sustainability of these family operations long into the future.”

The focus on these tax plans will lean heavily on the impacts to farmers and small businesses, even as the driver for these tax proposals is to collect taxes from stocks passed down in wealthy families.

Biden’s plan falls in line with some proposals from Senate Democrats in March as well.

March 29: Democrats Pitch Plan to Tax Capital Gains at Death

Recent Comments